Setting the right price for your product is one of the most important decisions you will ever make as a business owner. If you price too high, you might lose customers to the competition. If you price too low, you could struggle to keep your doors open.

Pricing often becomes confusing when comparing wholesale vs. retail. Wholesale focuses on bulk sales between businesses at lower rates, while retail focuses on selling individual products directly to end customers at higher prices.

In this guide, we will share the key differences between wholesale vs. retail pricing, explain the formulas you need to stay profitable, and show you concrete examples to help you set the perfect price for your products.

What is Wholesale Pricing?

Wholesale pricing is the discounted rate a manufacturer or distributor charges when selling goods in bulk to other businesses, such as retailers or trade professionals. The primary goal of wholesale is to move a high volume of inventory quickly.

Because the buyer is purchasing dozens, hundreds, or even thousands of units at once, the price per unit is significantly lower than the final price seen on a shop shelf.

In the wholesale model, profitability is driven by volume rather than high individual markups. For a manufacturer, selling 1,000 units with a modest profit margin is often more sustainable than trying to sell individual items to the public, as it reduces the cost of marketing and individual fulfillment.

The Wholesale Price Formula

To make sure each bulk sale stays feasible, wholesalers rely on a specific formula to protect their margins:

Wholesale Price = Cost of Goods Sold (COGS) + Overhead + Profit Margin

Where:

- Cost of Goods Sold (COGS) is the total cost to produce the item, including raw materials and direct factory labor.

- Overhead includes all the operating expenses such as warehouse rent, business rates, utilities, and staff salaries.

- Profit Margin is the percentage added to ensure the business can reinvest and grow (typically between 10% and 30%).

Example

Imagine you run a boutique clothing brand in the EU. To manufacture one high-quality organic cotton t-shirt, the fabric and labor cost €8.00 (COGS). You calculate that your studio rent and logistics add €2.00 per shirt (Overhead). To maintain your business, you add a €3.00 profit margin.

Using the formula: €8.00 + €2.00 + €3.00 = €13.00.

Your wholesale price is €13.00 per shirt. To ensure that every transaction is worth the administrative and shipping effort, you would set a Minimum Order Value (MOV).

For example, you might require a minimum spend of €500 per order. This secures that even if a retailer mixes and matches styles, the total volume remains high enough to justify the wholesale discount.

What is Retail Pricing?

Retail pricing is the final price that an individual consumer pays to purchase a single product. When you walk into a shop on the high street or browse an online store, the price you see on the tag is the retail price.

Unlike wholesale, which focuses on volume, retail is focused on the individual transaction.

Retailers act as the bridge between the manufacturer and the public. Because they handle the "last mile" of the sale, which includes expensive marketing, high-street rent, and customer service, their prices are significantly higher than wholesale prices to cover these extra costs and still make a profit.

The Retail Price Formula

To determine the right price for a consumer, retailers use a formula that accounts for the purchase cost plus all the extras required to sell the item:

Retail Price = Wholesale Price + Markup + Taxes + Fees

Where:

- Wholesale Price is the cost the retailer paid to the supplier to acquire the product.

- Markup is the added amount used to cover the retailer’s profit and operational costs (this is usually between 30% and 60%).

- Taxes often include VAT (Value Added Tax), which must be factored into the final price shown to the customer.

- Platform/Transaction Fees include marketplace commissions (like Amazon or Etsy fees) and credit card processing charges.

Example

Let’s go back to the organic cotton t-shirt. A retailer buys that shirt from the manufacturer at the wholesale price of €13.00.

To cover their shop rent in Berlin or London, staff wages, and social media advertising, the retailer adds a 100% markup (€13.00). They also need to account for a €1.00 transaction and packaging fee.

Using the formula: €13.00 (Wholesale) + €13.00 (Markup) + €1.00 (Fees) = €27.00.

Finally, depending on the area they sell in (for example, the UK or the US), they will add the appropriate VAT to reach a final shelf price (for example, €32.40 if a 20% tax is applied).

Unlike wholesale, there is no Minimum Order Value (MOV); customers are free to buy just one shirt.

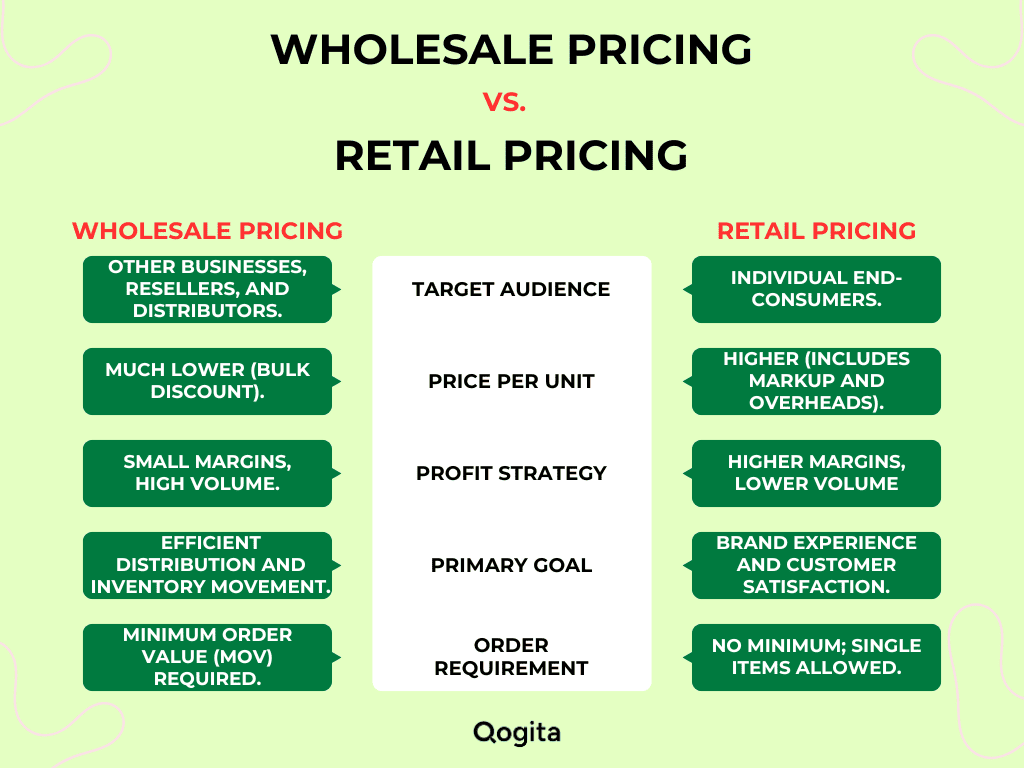

What is the Difference Between Wholesale vs. Retail Pricing?

While both models involve selling the same products, they operate in completely different worlds.

The main difference is that wholesale drives supply, ensuring products are manufactured and distributed in bulk. On the other hand, retail drives demand by focusing on the buyer's individual experience.

To help you better understand the differences between wholesale vs. retail pricing, here is a side-by-side comparison:

1. Target Audience and Buyer Intent

The most significant difference between wholesale vs. retail pricing lies in who is buying and why.

In wholesale, the buyer is typically a professional or another business owner (B2B). Their intent is profitability. They view the product as an asset they need to flip for a return.

Because of this, they are focused on the unit cost and the reliability of the supply chain. They don't care about fancy shopping bags; they care about the margin they can make.

In retail, the buyer is the end-user (B2C). Their intent is personal use or satisfaction. They are looking for a solution to a problem, a gift for a friend, or a treat for themselves.

Customers value things like brand prestige, immediate availability, and the ability to return the item easily if it doesn't fit.

2. Operational Focus and Added Value

Where the money is spent within the business differs greatly, which directly impacts the price.

A wholesaler’s costs are behind the scenes. They invest in warehousing, bulk logistics, and B2B sales teams. They save money by not having to worry about beautiful window displays or expensive social media influencers.

Retailers provide value-added services. The higher retail price covers the cost of prime high-street rent, helpful floor staff, attractive packaging, and easy-to-use websites.

When a consumer pays a higher price, they aren't just paying for the product; they are paying for the convenience of being able to buy one item, right now, in a pleasant environment.

3. Pricing Flexibility and Negotiation

How prices are set and changed is another key differentiator between wholesale vs. retail pricing.

Wholesale pricing is often dynamic and negotiable. In the UK and EU, trade relationships are built on volume. If a retailer agrees to a higher Minimum Order Value (MOV) or a long-term contract, the wholesaler will often lower the price per unit.

It is a relationship-based pricing model where "the more you buy, the less you pay."

Retail pricing is generally fixed and transparent. While there might be seasonal sales (like Black Friday or January clearances), a customer cannot walk into a retail shop and negotiate a better price for a single item. The price on the tag is the price everyone pays.

4. Tax Implications (VAT and Duties)

In the UK and EU, the way tax is handled marks a major divide between wholesale vs. retail pricing.

In wholesale, prices are often quoted exclusive of VAT. This is because businesses buying goods for resale can usually neutralise the VAT by claiming it back from the government. The focus here is on the "Net" cost of the goods.

Retail prices must include VAT by law when displayed to consumers. This immediately makes the retail price look at least 20% higher (depending on the country's tax rate) than the wholesale price.

The retailer acts as the tax collector, taking the VAT from the consumer and passing it on to the tax authorities.

What is the Difference Between Markup and Margin?

In business, people often use the terms markup and margin as if they were interchangeable. However, using them interchangeably is a common mistake that could bring about major financial errors.

Understanding the difference is necessary to ensure your business actually makes the profit you think it is making.

What is Markup?

Markup is the percentage added to the cost of a product to determine its selling price. It tells you how much more the selling price is compared to what you paid for the item.

The Formula for Markup:

Markup % = (Retail Price - Wholesale Price) / (Wholesale Price) x 100

Example: If you buy a pair of shoes for €50 (Wholesale) and sell them for €100 (Retail), your markup is 100%. You have doubled the cost.

What is Margin?

Margin (specifically Gross Margin) is the percentage of the selling price that is profit. It tells you how much of every Euro you take in is actually kept by the business after paying for the goods.

The Formula for Margin:

Margin % = (Retail Price - Wholesale Price) / (Retail Price) x 100

Example: Using the same shoes, you sell them for €100, and they cost you €50. Your profit is €50. Because €50 is half of the €100 selling price, your margin is 50%.

Why the Difference Matters

The confusion usually happens because the Euro amount of profit is the same (€50 in the example above), but the percentages are different (100% markup vs. 50% margin).

If you want to achieve a 50% margin, you cannot just add a 50% markup. If you add a 50% markup to a €50 item, you would sell it for €75. In that case, your profit is €25, which is only a 33.3% margin.

Markup is for setting prices (calculating from the bottom up), while margin is for measuring the health of your business (calculating from the top down).

What are the Most Common Pricing Strategies?

Choosing how to price your products isn't just about meeting costs; it’s about positioning your brand in the market. Depending on whether you are selling bulk to a shop in Paris or a single item to a customer in London, your strategy will change.

Here are the most effective pricing methods used in the UK and EU markets:

1. Keystone Pricing

This is the gold standard for retailers, especially in the clothing and giftware industries. Keystone pricing is simply doubling the wholesale cost.

- How it works: If the wholesale price is €20, the retail price is automatically set at €40.

- Pros: It’s very simple and secures a 50% gross margin.

- Cons: It might not account for high shipping costs or digital platform fees.

2. Cost-Plus Pricing

This pricing method involves calculating the total production cost and then adding a fixed percentage to ensure profit.

- How it works: If it costs €100 to make a gadget and you want a 20% profit, you sell it for €120.

- Pros: It guarantees that every single sale covers your expenses.

- Cons: It ignores competitors' pricing. If your production costs are high, you might price yourself out of the market.

3. Competitive and Dynamic Pricing

In the age of Amazon and high-street competition, many retailers use dynamic pricing. This means your price changes based on what others are charging or on demand.

- How it works: A retailer might lower the price of a popular coffee machine during "Black Friday" to match a competitor, then raise it back up in December.

- Pros: It keeps you relevant in a crowded market.

- Cons: It can result in price wars where profit margins are squeezed to almost zero.

4. Tiered (Volume-Based) Pricing

This is the ultimate strategy for wholesalers to increase their Minimum Order Value (MOV). You offer a lower price per unit the more a customer buys.

- How it works:

- 1–50 units: €10.00 each

- 51–200 units: €8.50 each

- 201+ units: €7.00 each

- Pros: It encourages retailers to place much larger orders.

- Cons: You must ensure your lowest tier still covers your overheads.

5. Value-Based Pricing

This strategy ignores the cost of production and focuses on perceived value. It is common for luxury brands or unique artisan goods.

- How it works: A designer handbag may only cost €50 to make, but because of the brand name and scarcity, it retails for €500.

- Pros: Allows for extremely high profit margins.

- Cons: Requires heavy investment in marketing and brand storytelling to justify the price.

How Does Pricing Vary Across Different Industries?

While the formulas for wholesale vs. retail remain the same, the standard markups vary considerably across industries.

Some sectors require higher margins to cover the risk of items going out of style, while others operate on razor-thin margins because they move products so quickly.

1. Clothing & Fashion

In the fashion industry, markups are usually on the higher end, often ranging from 3x to 5x the wholesale cost.

Why? Fashion carries a high level of risk. Retailers must factor in changing seasons, frequent returns, and the reality that unsold inventory often needs to be heavily discounted during seasonal clearance periods.

Benchmark: Wholesale €10 → Retail €30 to €50.

2. Consumer Electronics

Electronics operate on much tighter margins, usually between 5% and 15% for retailers.

Why? Competition is fierce, and products depreciate (lose value) very quickly as newer models are released. Because the individual price of an item (like a laptop or smartphone) is high, the retailer earns a decent profit even with a small margin.

Benchmark: Wholesale €500 → Retail €550 to €580.

3. Foodservice & Perishables

In the grocery and restaurant sector, the focus is on turnover speed.

Why? Since food spoils quickly, wholesalers and retailers cannot afford to have stock sitting on shelves. Wholesale margins are very low, but the volume is massive. Retailers often use loss leaders (selling staples like milk or bread at a very low price) to get customers into the shop.

Benchmark: Wholesale €1.00 → Retail €1.30 to €1.50.

4. Furniture & Home Goods

This industry usually falls in the middle, and it often uses the keystone pricing method.

Why? Furniture takes up a lot of physical space (high warehousing costs) and sells more slowly than clothing. The markup must cover the high cost of storage and delivery for large, heavy items.

Benchmark: Wholesale €150 → Retail €300 to €350.

5. Health (Pharmaceuticals & Supplements)

Margins in the health industry vary a lot depending on whether a product is a generic supplement or a patented medication, but they are typically strong overall.

Why? High Research and Development (R&D) costs, strict regulatory compliance, and the need for specialized storage (such as refrigeration) drive prices. For supplements, the markup is usually high to cover the massive marketing budgets required to stand out in a saturated market.

Benchmark: Wholesale €15 → Retail €30 to €45.

6. Beauty & Personal Care

The beauty industry is known for some of the highest markups in the retail world, frequently exceeding the fashion industry's 5x rule for high-end brands.

Why? Similar to fashion, beauty relies heavily on perceived value and brand prestige. The actual cost of ingredients (the "juice") is often very low compared to the cost of luxury packaging, celebrity endorsements, and high-end retail displays.

Benchmark: Wholesale €5 → Retail €25 to €40.

Common Mistakes to Avoid in Wholesale vs. Retail Pricing

Pricing is as much a psychological game as it is a mathematical one. Even with the right formulas, many businesses fall into traps that can damage their reputation or their bank balance. Here are the most common pitfalls to avoid in wholesale vs. retail pricing:

1. Undercutting Your Retail Partners

If you are a wholesaler who also sells Direct-to-Consumer (DTC) via your own website, you must be careful. If you sell your products at a special price that is much lower than your retailers' price, you are effectively competing against your own customers.

As a result, retailers will stop stocking your brand because they cannot compete with you. Always keep your DTC prices in line with the Recommended Retail Price (RRP).

2. Ignoring "Landed" and Hidden Costs

Many businesses calculate their retail price based only on the invoice they get from the supplier. They forget to include:

- Payment processing fees (1.5%–3% per transaction).

- Packaging and eco-taxes (important in the UK/EU for plastic/cardboard).

- Shipping and returns (especially the cost of free shipping offers). If these aren't in your formula, they will eat your profit margin.

3. Inconsistent Discounting

Running constant sales can train your customers to never buy at full price. In the retail world, if a product is always 50% off, the consumer begins to doubt the original value. For wholesalers, offering random discounts to one retailer and not another can leak out and destroy trade trust.

4. Not Reviewing Prices Regularly

Raw material and energy costs change over time. If your expenses increase by 10% and your pricing stays the same for six months, you end up losing margin on every sale. Avoid this by making it a habit to review your pricing at least once every quarter.

5. Keeping Pricing Structure Complex

Multiple tiers, hidden fees, or confusing codes make it hard for buyers to understand the real cost. Whether you’re selling to other businesses or directly to consumers, simplicity matters. A simple price list builds trust and encourages repeat purchases.

Conclusion

At the end of the day, pricing isn't just about numbers; it’s about balance. Wholesale gives you the volume and stability to keep your business running, while retail gives you the profit and the brand presence to help it grow.

By using the correct wholesale and retail pricing formulas and staying aware of industry benchmarks in the region you sell, you can make sure that your prices are both competitive and profitable.

Remember, pricing is dynamic so regularly review your costs and market trends to keep your business thriving in a changing economy.

Wholesale vs. Retail Pricing FAQs

How much cheaper is wholesale than retail?

Wholesale prices are typically 30% to 70% lower than retail prices. The price gap depends on the industry and volume; for example, high-end fashion has a much larger price difference than consumer electronics, where margins are notoriously thin.

What is the rule of thumb for wholesale pricing?

The standard rule of thumb is to calculate your total cost of production (COGS) and overhead, then add a 15% to 30% profit margin. Alternatively, many brands follow the 2.5x rule, multiplying their production costs by 2.5 to arrive at a sustainable wholesale price.

What is the typical markup from wholesale to retail?

In many industries, the typical markup is 100%, also known as keystone pricing, which doubles the wholesale cost. However, this can range from a 20% markup in electronics to a 300% markup in luxury goods or accessories to cover high marketing and retail overheads.

What percentage off is wholesale?

On average, wholesale prices represent a 40% to 60% discount off the Recommended Retail Price (RRP). This discount allows the retailer to cover their own expenses, such as rent, staff, and VAT.

What is the difference between wholesale price and MSRP?

The wholesale price is what the retailer pays the supplier for bulk goods, while the MSRP (Manufacturer’s Suggested Retail Price) is the price the manufacturer recommends the retailer charge the final consumer. The gap between these two numbers represents the retailer's potential gross profit.